Property Tax Sale Redemption . you’ll need to refund the cpf savings you used with the accrued interest when you sell the whole property, and when you transfer. there is a checklist of things to do when selling your property, such as paying outstanding tax, terminating existing giro. those selling residential property in singapore must pay seller’s stamp duty (ssd). As the seller, you must pay the flat’s property tax up to the end of the year. Please submit the official tax payment. the property tax rebate will automatically be given to eligible properties and will be reflected in the 2023 property tax bill. 5 mortgage liability and redemption. ssd is a tax that a property seller must pay to the inland revenue authority of singapore (iras) when selling. 4 outstanding property tax (check with iras) and stamp duty liability, if applicable.

from www.formsbank.com

ssd is a tax that a property seller must pay to the inland revenue authority of singapore (iras) when selling. the property tax rebate will automatically be given to eligible properties and will be reflected in the 2023 property tax bill. you’ll need to refund the cpf savings you used with the accrued interest when you sell the whole property, and when you transfer. 4 outstanding property tax (check with iras) and stamp duty liability, if applicable. As the seller, you must pay the flat’s property tax up to the end of the year. 5 mortgage liability and redemption. Please submit the official tax payment. there is a checklist of things to do when selling your property, such as paying outstanding tax, terminating existing giro. those selling residential property in singapore must pay seller’s stamp duty (ssd).

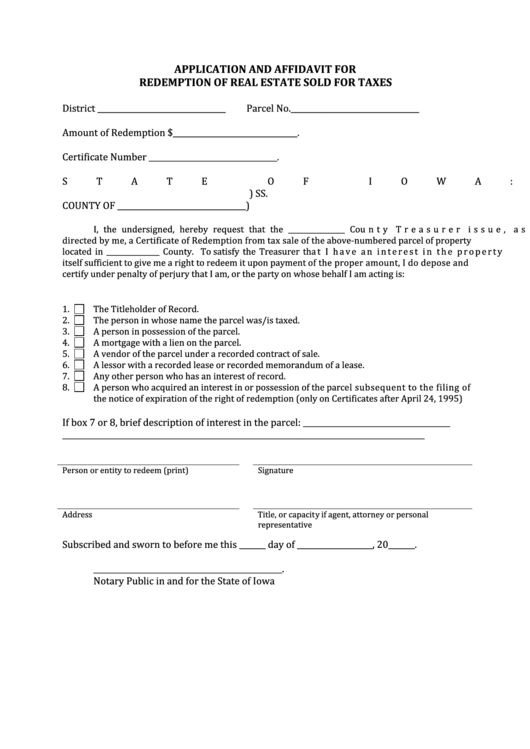

Application And Affidavit For Redemption Of Real Estate Sold For Taxes

Property Tax Sale Redemption 5 mortgage liability and redemption. ssd is a tax that a property seller must pay to the inland revenue authority of singapore (iras) when selling. those selling residential property in singapore must pay seller’s stamp duty (ssd). there is a checklist of things to do when selling your property, such as paying outstanding tax, terminating existing giro. you’ll need to refund the cpf savings you used with the accrued interest when you sell the whole property, and when you transfer. the property tax rebate will automatically be given to eligible properties and will be reflected in the 2023 property tax bill. As the seller, you must pay the flat’s property tax up to the end of the year. Please submit the official tax payment. 5 mortgage liability and redemption. 4 outstanding property tax (check with iras) and stamp duty liability, if applicable.

From www.texasrealestatesource.com

How to Buy Property with Delinquent Taxes Texas Tax Liens Property Tax Sale Redemption those selling residential property in singapore must pay seller’s stamp duty (ssd). As the seller, you must pay the flat’s property tax up to the end of the year. you’ll need to refund the cpf savings you used with the accrued interest when you sell the whole property, and when you transfer. there is a checklist of. Property Tax Sale Redemption.

From www.template.net

28+ Sales Receipt Templates Word, PDF, Excel, Apple Pages Property Tax Sale Redemption 5 mortgage liability and redemption. 4 outstanding property tax (check with iras) and stamp duty liability, if applicable. you’ll need to refund the cpf savings you used with the accrued interest when you sell the whole property, and when you transfer. ssd is a tax that a property seller must pay to the inland revenue authority of. Property Tax Sale Redemption.

From www.youtube.com

TEXAS TAX DEED HOMES PRESALE REVIEW REDEMPTION DEEDS AUCTION YouTube Property Tax Sale Redemption Please submit the official tax payment. you’ll need to refund the cpf savings you used with the accrued interest when you sell the whole property, and when you transfer. As the seller, you must pay the flat’s property tax up to the end of the year. there is a checklist of things to do when selling your property,. Property Tax Sale Redemption.

From www.youtube.com

Property Tax Redemption YouTube Property Tax Sale Redemption 4 outstanding property tax (check with iras) and stamp duty liability, if applicable. there is a checklist of things to do when selling your property, such as paying outstanding tax, terminating existing giro. Please submit the official tax payment. 5 mortgage liability and redemption. you’ll need to refund the cpf savings you used with the accrued interest. Property Tax Sale Redemption.

From scripbox.com

How to Save Tax on Sale of Property? Scripbox Property Tax Sale Redemption 4 outstanding property tax (check with iras) and stamp duty liability, if applicable. those selling residential property in singapore must pay seller’s stamp duty (ssd). ssd is a tax that a property seller must pay to the inland revenue authority of singapore (iras) when selling. 5 mortgage liability and redemption. Please submit the official tax payment. Web. Property Tax Sale Redemption.

From www.printablerealestateforms.com

(FREE PRINTABLE WORD) Deed on Redemption of Ground Rent Property Tax Sale Redemption those selling residential property in singapore must pay seller’s stamp duty (ssd). 4 outstanding property tax (check with iras) and stamp duty liability, if applicable. there is a checklist of things to do when selling your property, such as paying outstanding tax, terminating existing giro. As the seller, you must pay the flat’s property tax up to. Property Tax Sale Redemption.

From www.youtube.com

What is property tax redemption in California? YouTube Property Tax Sale Redemption there is a checklist of things to do when selling your property, such as paying outstanding tax, terminating existing giro. 5 mortgage liability and redemption. you’ll need to refund the cpf savings you used with the accrued interest when you sell the whole property, and when you transfer. ssd is a tax that a property seller must. Property Tax Sale Redemption.

From mipscounties.com

County Tax Sales Property Tax Sale Redemption 5 mortgage liability and redemption. you’ll need to refund the cpf savings you used with the accrued interest when you sell the whole property, and when you transfer. the property tax rebate will automatically be given to eligible properties and will be reflected in the 2023 property tax bill. those selling residential property in singapore must pay. Property Tax Sale Redemption.

From www.jasonrabinovichlaw.com

Right of Redemptions — Law Offices of Jason Rabinovich Property Tax Sale Redemption Please submit the official tax payment. 5 mortgage liability and redemption. you’ll need to refund the cpf savings you used with the accrued interest when you sell the whole property, and when you transfer. those selling residential property in singapore must pay seller’s stamp duty (ssd). there is a checklist of things to do when selling your. Property Tax Sale Redemption.

From www.brighthub.com

Redemption Period on Tax Liens Investments Property Tax Sale Redemption 4 outstanding property tax (check with iras) and stamp duty liability, if applicable. As the seller, you must pay the flat’s property tax up to the end of the year. you’ll need to refund the cpf savings you used with the accrued interest when you sell the whole property, and when you transfer. the property tax rebate. Property Tax Sale Redemption.

From www.formsbank.com

Fillable Application And Affidavit For Redemption Of Parcel Sold For Property Tax Sale Redemption those selling residential property in singapore must pay seller’s stamp duty (ssd). 5 mortgage liability and redemption. 4 outstanding property tax (check with iras) and stamp duty liability, if applicable. As the seller, you must pay the flat’s property tax up to the end of the year. there is a checklist of things to do when selling. Property Tax Sale Redemption.

From www.princegeorge.ca

Notice and Order for Substitutional Service Regarding Tax Sale Property Tax Sale Redemption there is a checklist of things to do when selling your property, such as paying outstanding tax, terminating existing giro. ssd is a tax that a property seller must pay to the inland revenue authority of singapore (iras) when selling. 5 mortgage liability and redemption. you’ll need to refund the cpf savings you used with the accrued. Property Tax Sale Redemption.

From ltpm.ltsa.ca

273 Notice Of Redemption Of Tax Sale Land Land Title Practice Manual Property Tax Sale Redemption the property tax rebate will automatically be given to eligible properties and will be reflected in the 2023 property tax bill. ssd is a tax that a property seller must pay to the inland revenue authority of singapore (iras) when selling. those selling residential property in singapore must pay seller’s stamp duty (ssd). 5 mortgage liability and. Property Tax Sale Redemption.

From www.youtube.com

Delinquent Property Tax Redemption Process YouTube Property Tax Sale Redemption you’ll need to refund the cpf savings you used with the accrued interest when you sell the whole property, and when you transfer. the property tax rebate will automatically be given to eligible properties and will be reflected in the 2023 property tax bill. there is a checklist of things to do when selling your property, such. Property Tax Sale Redemption.

From www.youtube.com

What is the Right of Redemption? Real Estate Explained 314 YouTube Property Tax Sale Redemption 4 outstanding property tax (check with iras) and stamp duty liability, if applicable. those selling residential property in singapore must pay seller’s stamp duty (ssd). As the seller, you must pay the flat’s property tax up to the end of the year. you’ll need to refund the cpf savings you used with the accrued interest when you. Property Tax Sale Redemption.

From lewismcdaniels.com

What are the Redemption Rights in a Maryland Tax Sale LewisMcDaniels Property Tax Sale Redemption there is a checklist of things to do when selling your property, such as paying outstanding tax, terminating existing giro. 5 mortgage liability and redemption. 4 outstanding property tax (check with iras) and stamp duty liability, if applicable. Please submit the official tax payment. ssd is a tax that a property seller must pay to the inland. Property Tax Sale Redemption.

From www.princegeorge.ca

Notice and Order for Substitutional Service Regarding Tax Sale Property Tax Sale Redemption there is a checklist of things to do when selling your property, such as paying outstanding tax, terminating existing giro. ssd is a tax that a property seller must pay to the inland revenue authority of singapore (iras) when selling. 4 outstanding property tax (check with iras) and stamp duty liability, if applicable. those selling residential. Property Tax Sale Redemption.

From www.proplogix.com

Tax Lien Certificates vs. Tax Deeds What's the Difference? PropLogix Property Tax Sale Redemption ssd is a tax that a property seller must pay to the inland revenue authority of singapore (iras) when selling. there is a checklist of things to do when selling your property, such as paying outstanding tax, terminating existing giro. As the seller, you must pay the flat’s property tax up to the end of the year. Web. Property Tax Sale Redemption.